This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. However, a major disadvantage is that the graph does not clearly reveal how costs vary with changes in activity. The P/V graph is a simple and convenient way to show the extent to which profits are affected by changes in the factors that affect profit. The intersection of the profit line with the horizontal line gives the break-even point. Points above the line measure profits while points below the line measure losses.

Step 5 – Determine the Break-Even Point in the Chart

He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. If the price stays right at $110, they are at the BEP because they are not making or losing anything. Options can help investors who are holding a losing stock position using the option repair strategy. At that breakeven price, the homeowner would exactly break even, neither making nor losing any money. The following example of the break-even chart provides an outline of the most common type of break-even chart present. Each of the examples of the breakeven chart states the topic, relevant reasons, and additional comments wherever required.

Ask a Financial Professional Any Question

There will be a need to work out the variable costs related to your new product and set prices before you start selling. Thus, the unit variable costs to make a single dress is $110 ($60 in materials and $50 in labor). In terms of its cost structure, the company has fixed costs (i.e., constant regardless of production volume) that amounts to $50k per year. Recall, fixed costs are independent of the sales volume for the given period, and include costs such as the monthly rent, the base employee salaries, and insurance.

- This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

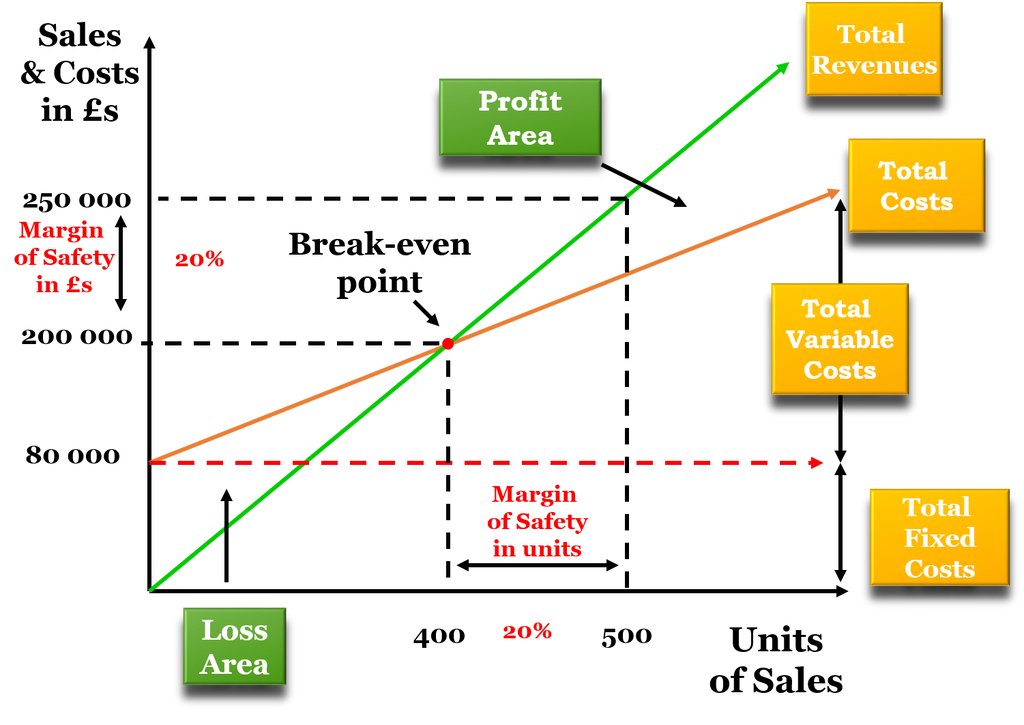

- Where the revenue line crosses the total cost line is the break-even point -costs and revenue are the same.

- Let’s say that we have a company that sells products priced at $20.00 per unit, so revenue will be equal to the number of units sold multiplied by the $20.00 price tag.

- A higher contribution reduces the number of units needed to break even because each unit contributes more towards covering fixed costs.

How confident are you in your long term financial plan?

It shows that the company Bag Ltd. would be required to sell the 10,000 units of bags to achieve the break-even at the given fixed cost, selling price, and the variable cost of the bag. A break-even chart is constructed such that units are plotted on the x-axis and revenue/cost on y-axis. It is useful only when the production is inside the relevant range i.e. output bracket in which fixed costs do not change. The formula for calculating the break-even point (BEP) involves taking the total fixed costs and dividing the amount by the contribution margin per unit. Upon selling 500 units, the payment of all fixed costs is complete, and the company will report a net profit or loss of $0. To find the total units required to break even, divide the total fixed costs by the unit contribution margin.

In other words, if this dressmaker sells 1,125 units of this particular dress, then she will fully recover the $45,000 in fixed costs she invested in production and selling. Every business must develop a break-even point calculation for their company. This will give visibility into the number got tips better report them of units to sell, or the sales revenue they need, to cover their variable and fixed costs. The break-even point is defined as the output/revenue level at which a company is neither making profit nor incurring loss. For a company to make zero profit, its total sales must equal its total costs.

Gathering Information for Analysis

For instance, consider the possibility of keeping the price at $150, but having a celebrity endorse the dress (think Madonna!) for a fee of $20,000. To show how break-even works, let’s take the hypothetical example of a high-end dressmaker. Let’s assume she must incur a fixed cost of $45,000 to produce and sell a dress. The algorithm does the rest for you – it automatically calculates your profit margin and markup, and your break-even point both in terms of units sold and cash revenue.

Construct a chart with output (units) on the horizontal (X) axis, and costs and revenue on the vertical (Y) axis. Onto this, plot a horizontal fixed costs line – it is horizontal because fixed costs don’t change with output. The total variable costs will therefore be equal to the variable cost per unit of $10.00 multiplied by the number of units sold.

In other words, the no-profit-no-loss point is the break-even point. The simplest form of the break-even chart, wherein total profits are plotted on the vertical axis while units sold are plotted on the horizontal axis. The units sold are plotted on the horizontal axis, while total revenue is shown on the vertical axis. Where the revenue line crosses the total cost line is the break-even point -costs and revenue are the same.

Leave a Reply